For most of us, there is a goal, a direction or purpose as to why we are undertaking these acts of frugality or careful investment efforts. For some, it is an easing of mind: that things will get easier in the future, that it will enable some sort of freedom. For others, it is a big, green ‘EXIT’ sign from the rat race of their careers. Others aim to be able to spend more time with friends, family or interests or aim to fight against a form of consumerism.

Whatever the motivation: a lot of people striving for some form of financial independence sooner or later will mention the need for a passive income. For that, on this website, I’ll use the metaphor of a lobster trap.

The latter is passive fishing equipment. Just as with passive income, the idea is to put it a significant amount of effort first (getting the traps, setting them up) and then…wait. If you have enough of these set up, the idea is that you might be able to cruise through life without any financial worry. All you need to do is manage the traps.

The idea of a lot of people aiming to achieve FIRE is relatively simple: there is enough passive income coming in to support them in their lifestyle. The need for a traditional salary (and hence, doing a regular job), can in this case be reduced or disappear. The means to achieve that however are, unfortunately, not that simple.

In this article, I’ll have a look of some at the ‘lobster traps’ I aim to set up in the next year.

Table of Contents

Dividends

Across the Atlantic, in the United States, a lot of people are looking into periodic dividends flowing in to boost their funds. A dividend is a sum that is paid out of the profits of a company to its shareholders. How much dividend is given per share, is normally determined by the board of directors and will usually take into account the performance of the company, as well as the need for future investment and expectations from shareholders. Note that having a share does not entitle you by default to a certain dividend. There are plenty of (very valuable) firms out there who have not given out dividends yet.

Yet certain companies are known for being more generous with their dividends than others. You will need quite a lot of shares (which in turn, requires quite a big sum of cash) to provide an income on what you could actually live on. Of course, you can also profit from the increases in the price of the shares you own, but note that this can also be turned the other way around! There is a certain risk to this strategy.

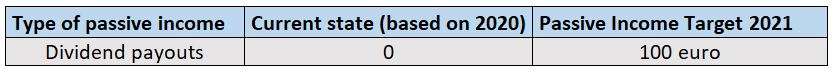

For me personally, I did not have any individual shares last year. I am planning to change this slightly. Of course, it will only be a rather modest investment, as you can see from my goal this year. Certainly hope to add it to this in the years the come. Slow & steady wins the race!

There are two other things to point out. First, it is taxes. Certainly, in Belgium where I’m from, dividends from for instance American firms can be taxed highly. This makes this a bit less appealing strategy for a lot of people. Taxes (at the moment of writing) of Belgian firms are 30%.

Secondly, there are also ETF’s who pay out dividends.

ETF

ETF’s are a cornerstone for a lot of people aiming for a FIRE status. They typically have quite low costs related to them. Dividend-wise, there are two types of ETF. The first just distributes dividends (which then are also subject to taxes), whereas the other directly reinvest them again. The latter is why these are quite popular, certainly in regions where taxes are quite high (like Belgium).

I’ll try to go into more details on ETF’s in a separate article, as it certainly is a topic that requires some additional attention.

Personally, I am quite fond of having a large percentage of one’s portfolio in ETF’s. I only started out in 2020 with this (investing about 2K in 2020). I hope to boost this to about 5K in 2021. I will for sure keep you updated of my progress on this!

Real estate

The mother of all passive incomes: collecting a monthly rent! Although you can argue how ‘passive’ this is (things needing fixing,..), it is a vast source of additional income. Certainly in Belgium, a lot of people who have already accumulated some wealth, opt for an additional house or apartment to rent out. This is because, in a lot of areas, prices have barely dropped (quite the contrary in fact). It is hence seen as quite a safe investment. A lot of people try to get a rent that actually covers the mortgage (or, even better, exceeds it). Note that:

- It is hard to ‘start out’ with if you don’t have a nice pot of cash stashed aside. Having a high & safe salary could help to get a better & more flexible deal on a mortgage.

- There is a risk of changing taxation when it comes to rent

- It is perhaps ambitious to think that you will have your property rented out all the time.

- It requires some time from your end as well, so you could argue how ‘passive’ this is. As a landlord, you have some responsibility towards the people renting your place. Problems with electricity, water,..

Alternative income sources: advertising revenue

The three methods mentioned above are the ‘typical go-to’ options. They require some capital already though. There are more obscure and alternative sources of passive income.

In the past, when I was quite young, I already experimented with some websites. For a while, I wrote for a music related blog which was bringing in a (very modest) amount of advertising cash which had to be shared with about 10 people. We ultimately ended up just putting it back into the blog itself, as it was too small sum to start redistributing with such a large number of people.

It was an idea that however always kept floating around in the back of my mind. The idea of having a website which:

- Requires a low maintenance (unlike the music blog or this website, which has frequent posts). A good example would be this kind of website.

- Has a steady number of visitors, hence creating a modest but constant source of daily extra cashflow coming in which would be enough to cover the costs of hosting and of course provide some extra money coming in on top.

I figured that this, I thought, would in fact be some sort of perpetuity, if both conditions above are met, of course. The idea would be that you put in a lot of effort upfront (by building a website which has nice, unique content that barely requires updating) and then afterwards are able to reap the fruits for a long, long time.

There are (of course) some difficulties with this. You need to

- Find a topic, which you want to write about and spent time & effort in

- Take the gamble that people will want to read it, in large enough numbers, to cover your costs (hosting, domain,..)

- That it is still relevant in 10 years

Two years ago, I more or less found such an opportunity (although it was certainly not my initial goal). I created a forum for the fans of a football club I like, and it is now a flourishing community of about 200 users, a lot of whom revisit on a daily basis. It almost runs itself (as people create the content themselves). I installed a very low amount of advertising on it and now I am break-even on a monthly basis. I am quite confident I can triple the money coming in by just increasing the amount of ads (without affecting the customer experience too much), and the community is still growing! For me, this is a nice lobster trap, and I will try to expand it more in the year to come.

Alternative income sources: data

I already wrote an extensive piece on Cake, but this will also contribute a small sum to my passive income target for 2021. Nothing shocking of course, but I thought it would be worth mentioning nonetheless. I don’t really have control over the target, but I expect it to be around 12 euros per year.

My take on passive income & goals for 2021

So all in all, I hope to receive a bit more than €160 from passive income. A very modest sum, but keep in mind that:

- I’ve only been on this journey for some months

- Passive income does not equal saving or an increase in net worth. In a way, you could actually see it as the fruits from an increase in net worth!

In the year after, I’m quite confident I can set the bar a bit higher. The majority of the money I had saved up until now when into the purchase of my home (and apart from that, I’m still spending quite some money on fixing up some areas of the house, which I hope will wrap up around spring).

So: what did I miss? Are you setting some targets for yourself next year? Feel free to share your feedback!